Report: Automotive Wrap Films Market Size Worth $17.6 Billion by 2027

It's projected to grow from $3.5 billion in 2019 at a CAGR of 22.5% from 2020-2027

Below is information shared from Grand View Research’s latest report, located here.

In 2019, the global automotive wrap films market size valued at $3.5 billion. Grand View Research expects the market to grow at a CAGR of 22.5% from 2020-2027. It anticipates the growing sign and graphics industry, low cost, and increasing demand for mobile advertising to fuel the suggested growth.

Additionally, modernization of consumer lifestyle, combined with rising demand for personalization of cars, is anticipated to have a positive impact on demand for automotive wrap films. Grand View Research attributes this expected increased interest to factors like improving the standard of living and rising disposable income, especially in emerging economies (China and India). Grand View Research projects that the growing demand for customization on light-duty vehicles like cars and two-wheelers will drive the automotive wrap films market.

The increasing acceptance of solid-colored automotive wrap films is projected to grow demand among consumers in the U.S. Examples include matte black, blue, matte orange, pink, and green.

Automotive wrap films are being increasingly used in various applications, including heavy-duty, light-duty, and medium-duty vehicles. These films are a cost-effective and cost-efficient method for customization of any vehicle as they protect the original paint of the car and retain its resale value. An increasing interest in the long-term protection of vehicle paint will likely fuel the demand for automotive wrap films over the forecast period, 2020-2027.

However, the technical complexity associated with the installation of these films could restrain the market growth during the forecast period. The installation of wrap films requires specific environmental conditions to ensure correct application and placing. If installed outdoors, pieces of dirt can stick to the vehicle surface and form a layer between the vehicle surface and the film. Thus, it is imperative to install the wrap film in a clean and dirt-free indoor facility. Temperature is also a requisite in the proper installation of automotive wraps. If the temperature is too high, the wrap might overstretch, while at low temperatures, the film shrinks.

Applications

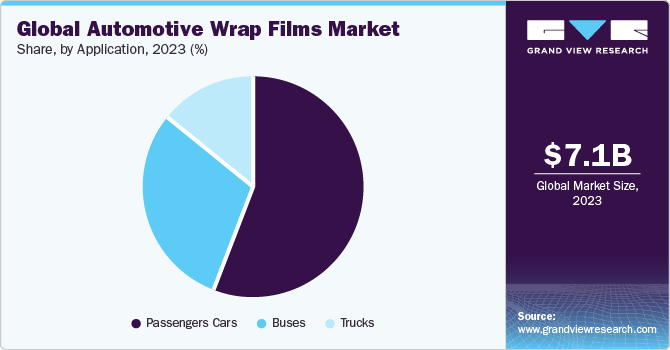

The automotive wrap films market has three major segments: heavy-duty vehicles, medium-duty vehicles, and light-duty vehicles.

In 2019, light-duty vehicles held the largest share in the market, and will likely maintain this dominance between 2020-2027. Growing demand for colorful graphics for SUVs, personal cars, and vans, coupled with rising opportunities for drivers to earn money through advertisements, is anticipated to propel interest for wrap films in light-duty vehicles over the forecast period.

The heavy-duty vehicles segment held a significant share in 2019, and the report predicts it will grow at a steady CAGR between 2020-2027. Increasing awareness regarding the importance of branding and marketing and the growing number of impressions per day has led to an interest in wrap film application on heavy-duty vehicles over the past few years.

By Region

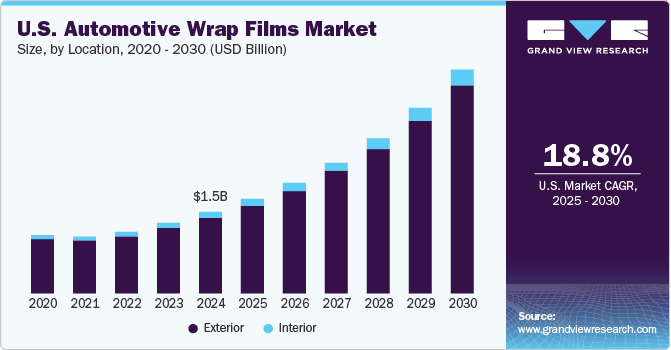

North America held the largest share in the global market for automotive wrap films in 2019. Early modernization of North America, coupled with a high adoption rate of new technologies in the region, has led to high demand for personalization of cars, ultimately leading to the growth of the market.

According to the report, the Asia Pacific region will likely witness the fastest growth over the forecast period. The growing interest of consumers in automotive wrap films for color change and paint protection is likely to propel demand over the forecast period. The low cost and maintenance of vehicles and resale value are expected to drive growth between 2020-2027.